Inflation Has Crashed Below Target — So Why Are Rates Still High?

Let’s break it down.

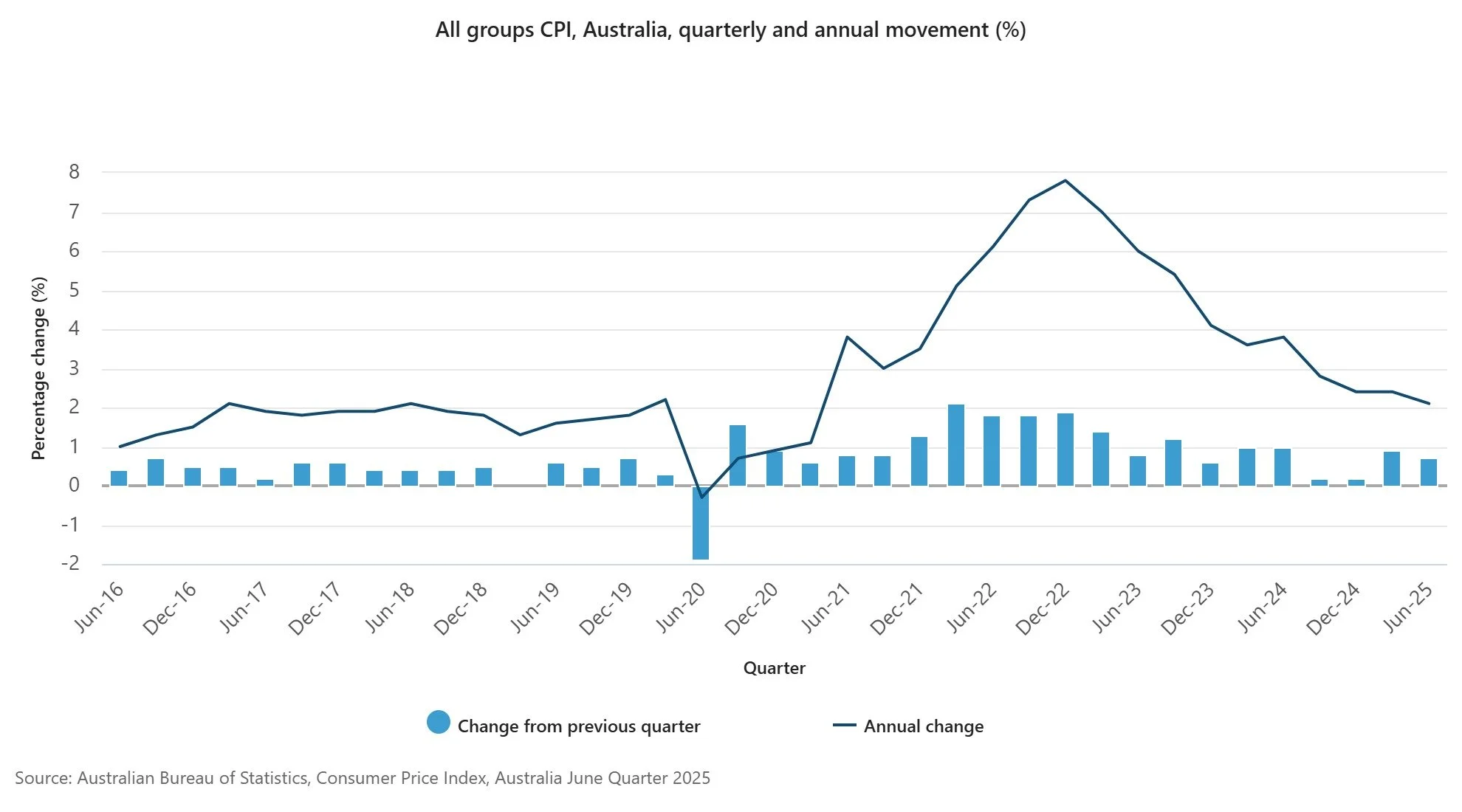

The latest inflation data out of Australia is nothing short of staggering and it could have major implications for property investors. Using the monthly CPI figures, which are more up-to-date than the quarterly stats, inflation has now dropped to just 1.9% well below the RBA’s official target range of 2–3%.

Even the “trimmed mean” measure which filters out volatile price spikes is sitting at 2.1% annually.

To put that into context: this time last year, we were staring down a 6% inflation rate and back-to-back interest rate hikes. Fast forward to now? Inflation is not only under control it’s below where the Reserve Bank wants it to be. And yet, interest rates are still sitting at a restrictive 3.85%.

That’s where things get frustrating.

The RBA Might’ve Gone Too Hard, Too Fast

There’s growing concern that the RBA has made some serious missteps over the past 12 months. By hiking rates aggressively and holding them high, they’ve arguably overcorrected and the consequences are showing.

GDP growth has been limping along, stuck under 2% for the past two years.

Unemployment has ticked up to 4.3%, after bottoming out at 3.5%.

Consumer spending has dropped. Businesses are pulling back.

And most importantly inflation has already come crashing down.

Many economists now believe the RBA should have already started cutting rates. The data is there. The pressure on Aussie households is very real. And by keeping rates higher for longer, the RBA is putting further strain on the economy potentially risking thousands of jobs in the process.

So, What’s This Mean for You as an Investor?

For property investors, especially those getting started, timing matters. A slowing economy and falling inflation typically signal a rate cut cycle ahead and historically, when interest rates fall by 1%, property prices increase by around 8%.

This could be the window smart investors have been waiting for.

If you’ve been sitting on the sidelines, unsure whether now’s the right time to enter the market you might want to look twice. When rates eventually drop (and all signs are pointing that way), we could see another wave of competition hit the market.

Early movers are usually the ones who benefit the most.

Why the RBA Needs to Pay Attention to Monthly Data

A big part of the debate right now is how the RBA interprets inflation data. While the monthly CPI gives us a real-time pulse on the economy, the RBA has been placing more weight on the older, quarterly numbers.

But here’s the thing: the monthly numbers are picking up the turning point now. Not two months from now. Not next quarter.

If the RBA continues to ignore the current data, we risk deeper economic pain more job losses, more pressure on households, and more missed opportunities.

What Needs to Happen Next

There’s a strong case for the RBA to:

Deliver a 50 basis point rate cut as early as August.

Follow with additional 25 basis point cuts in the months ahead.

Shift to a more accommodative policy setting somewhere closer to 3.25% or lower.

Because let’s face it — if inflation is already below target and the economy is slowing, keeping rates high is only going to make things worse.

At Baker Advocates, we watch these trends closely not just for the macro view, but because they impact your decisions as an investor. Whether you’re buying your first investment property or planning your next move, understanding the broader economic picture helps you act with confidence.

Right now, we’re seeing a rare alignment:

✔️ Inflation is under control

✔️ Rate cuts are likely coming

✔️ Buyer competition hasn’t returned in full force yet

If you’ve been waiting for the right conditions to build your portfolio — this could be your moment.

Want help navigating it?

We help everyday Aussies invest smarter, avoid the common pitfalls, and secure high-performing properties across Australia. Click the link below to book your free discovery call and let’s talk strategy.