Why the RBA Holding Rates at 3.60% Means Now Is the Time to Buy (Especially in Geelong Real Estate)

What just happened

The Reserve Bank of Australia (RBA) has opted to keep the cash rate steady at 3.60%, following their latest board meeting.

In their statement the board noted:

“The Board’s judgement is that some of the increase in underlying inflation in the September quarter was due to temporary factors. The central forecast in the November Statement on Monetary Policy, which is based on a technical assumption of one more rate cut in 2026, has underlying inflation rising above 3 per cent in coming quarters before settling at 2.6 per cent in 2027.”

That means inflation is still elevated, and while a cut is expected somewhere down the track, not yet.

Why this is good news for buyers and investors

A rate-hold means borrowing costs aren’t rising further right now. That gives you time and less urgency to act.

The RBA expects inflation to stay above 3% for the short term, they’re likely to keep the rate where it is until the inflation fears ease. That means the window to buy under more favourable conditions remains open a little longer.

This is the key, when the next rate cut does arrive (forecast is 2026), there’s a strong chance that property prices will lift. Lower rates → increased purchasing power → more competition.

For markets like the Geelong region, which already appeal for investment (younger families, growth corridor, lifestyle plus commuter access), this is a moment to pounce rather than wait.

What this means for Geelong real estate

If you’re looking to invest in Geelong real estate:

The current environment gives you a strategic advantage. Acting now means you can secure property before the competition intensifies.

Geelong ticks many boxes in a high-growth plan: access to Melbourne, regional growth momentum, lifestyle drawcards—all important criteria for strong capital growth.

If rate cuts come and prices inflect upward, the cost of entry for first-time investors or upgrade/downsizer buyers will likely increase. So locking in sooner can translate into better value.

What to do next

Get your finance in place – being ready means you can act quickly when the right opportunity in Geelong shows up.

Target suburbs around Geelong that align with strong fundamentals (disposable income catchment, supply-demand tightness, amenity, school zones).

Position yourself now, so you’re ahead of the curve. When rates drop and more buyers enter the market, you’ll want to be already selected and ready.

Work with the right team – as a buyer’s agent, I can help identify those opportunities in Geelong and beyond, negotiate effectively, and coordinate the process end-to-end.

Final thoughts

Holding the rate at 3.60% means the RBA hasn’t taken away the ammo it has simply delayed the trigger. For property investors, especially in Geelong, this delay is your window of opportunity. Waiting too long might mean facing higher competition and higher entry costs when the next wave comes.

If you’re ready to explore how to act now let’s chat. I’d love to walk you through Geelong’s current hotspots and how you can secure a smart investment before the market gets ahead of you.

In today’s property market, speed wins.

The property market is moving fast right now and hesitation is costing people opportunities.

We’re seeing homes snapped up within days (sometimes hours), and too many buyers are missing out simply because they can’t move quick enough or don’t know what to do next.

Just last week, we helped one of our clients secure a high-performing investment property in under 24 hours from sourcing, inspecting, negotiating, to closing the deal on contract.

Here’s what happened:

We identified a great property in a suburb in Geelong that ticked all the boxes. We immediately inspected, ran the numbers, confirmed the strategy, and negotiated hard to get it locked in before it even hit the wider market. We made sure we closed the deal before the first open.

If the client had hesitated, it would’ve been gone the next day.

In this market, being prepared isn’t enough you need to be positioned to act.

That’s where working with a buyer’s agent changes the game.

We help clients move fast and smart leveraging off-market opportunities, deep local insight, and a clear process that gets deals done before the competition even knows they exist.

What are you seeing out in the market at the moment? What are you war stories on missing out on properties?

Why Rising Unemployment Could Signal Opportunity for Property Investors

When the latest unemployment data dropped, a lot of people panicked but smart investors saw an opportunity.

According to the ABS, Australia’s unemployment rate has climbed to 4.5%, the highest level in around four years. That might sound worrying on the surface, but when you dig a little deeper, it could actually be good news for property investors.

The Problem: The Market’s Slowing, and People Are Hesitating

A rising unemployment rate usually means fewer people are working, spending, and borrowing. As confidence dips, many potential buyers hit pause waiting to “see what happens next.”

The problem with that? Markets don’t wait.

While most people sit on the sidelines, opportunities quietly build. Supply remains low, and demand is only being delayed — not erased. The result? Once confidence returns, competition floods back, and prices rise fast.

The Solution: Understanding the Bigger Picture

When unemployment goes up, it often pushes the Reserve Bank of Australia (RBA) to step in and support the economy.

How? By cutting interest rates.

Rate cuts mean lower borrowing costs, easier access to finance, and ultimately, more demand in the housing market. This is the start of what’s known as the “recovery phase” of the property cycle and those who position themselves early are usually the ones who benefit most.

If you buy before rate cuts hit, you’re purchasing in a quieter market, likely negotiating better deals and setting yourself up to enjoy capital growth once buyer activity surges again.

What Investors Should Do Now

If you’re serious about growing wealth through property, this is the time to start getting your finances and strategy in order not six months from now when everyone else jumps back in.

Here’s what you can do:

Review your borrowing capacity — even if you’re not buying tomorrow, know your numbers now.

Assess your equity — your current home or investment could help fund your next purchase without saving another cent.

Start researching strong-performing markets — focus on areas with limited supply, high rental demand, and strong local economies.

Work with professionals — having the right buyer’s advocate, broker, and conveyancer makes the process seamless and ensures you’re buying smart, not emotionally.

The Bottom Line

While the headlines might sound negative, this kind of market shift is exactly what experienced investors look for.

When others hesitate, they prepare. When the rate cuts arrive, they act — and that’s where the real wealth is built.

At Baker Advocates, we help everyday families take advantage of these market cycles by identifying high-growth opportunities before the crowd catches on.

If you’re ready to position yourself ahead of the next property upswing, click here to book your free discovery call.

Geelong set to boom! Why not all suburbs are equal…

Geelong property market 2025 is heating up, but not all suburbs are equal. Discover the best suburbs to invest in with data-driven insights.

Thinking about investing in Geelong property? With Geelong back on the national radar as one of the best places to buy in 2025, many buyers are rushing in but here’s the catch: not all suburbs are performing equally. For investors and homebuyers, understanding the micro-markets within Geelong is the difference between buying a property that outperforms and one that lags behind.

The Big Picture: Geelong’s Market Resurgence

The Geelong property market in 2025 is gaining momentum. Affordability is appealing compared to Melbourne, interest rates are stabilising, and hybrid work continues to make regional living more attractive. Together, these factors have pushed Geelong back into the spotlight as one of Australia’s strongest regional markets.

Suburbs such as Corio, Norlane and Belmont have already recorded sharp increases in sales activity, a signal that demand is heating up. And as history shows, sales activity is often the leading indicator of future price growth.

Why Not All Geelong Suburbs Are Equal

Despite the positive headlines, the Geelong real estate market is not a single, uniform entity. Each suburb has its own trajectory, shaped by infrastructure, amenities, buyer demand, and investor interest.

Sales activity leads price growth: Areas seeing strong transaction volumes today are likely to experience price growth tomorrow.

Affordability is attracting investors: Cheaper entry points are pulling in first-home buyers and investors, but not all affordable suburbs will deliver long-term growth.

Interstate buyers are snapping up stock: Buyers from Sydney, Brisbane, and Perth are increasingly targeting Geelong, particularly in growth-focused suburbs.

The Importance of Data in Property Investing

Relying on headlines or hearsay can be risky. The smartest investors use Geelong property data to validate decisions — tracking where demand is outpacing supply, which suburbs are attracting interstate buyers, and where infrastructure projects will drive long-term value.

Key data points worth monitoring include:

Quarterly sales volumes and transaction growth

Median house and unit price trends

Suburb-level affordability compared to Melbourne

Investor versus owner-occupier ratios

Planned infrastructure and amenity upgrades

Expert Insight: “You Need Someone in Your Corner”

Troy Baker, Buyers Agent & Director of Baker Advocates, explains:

“We have really seen some locations of the Geelong market take off. Many buyers are missing out as interstate investors are swarming and snapping up properties quickly. This is why it’s important to have someone in your corner like a buyer agent who knows the Geelong market.”

He adds: “The prime suburbs are Belmont, Grovedale, Highton and Bell Park, with Belmont seeing a 6.2% rise in asking price for the rolling quarter.”

Best Suburbs in Geelong 2025

According to Baker Advocates, standout performers include:

Belmont – strong family demand, +6.2% rise in asking prices in the last rolling quarter.

Grovedale – affordable entry point with proximity to key infrastructure.

Highton – lifestyle appeal and consistent long-term growth.

Bell Park – solid yields and growing investor interest.

These Geelong suburbs are showing signs of strong fundamentals that position them above the broader market.

What Buyers Should Do in 2025

Do your homework – research each suburb, not just Geelong as a whole.

Engage a local expert – work with a Geelong buyer’s agent who understands suburb-level dynamics.

Move strategically – secure property before media hype pushes prices higher.

Don’t follow the crowd blindly – validate opportunities using hard data, not speculation.

The Geelong property market in 2025 is packed with opportunity, but not all suburbs are created equal. Strategic investors who rely on suburb-level data and local expertise will be best positioned to capitalise on this wave of growth. For those on the sidelines, the message is clear: know where to buy, and move before the market moves without you.

The Perfect Storm in Property: Why Waiting Could Cost You Big

Last weekend, I stood at an auction and witnessed something that perfectly sums up where the property market is heading.

The property ended up selling for $113,000 above the quoted range… and there were 16 active bidders fighting for it.

That’s not just a competitive auction – that’s a clear signal the market is heating up fast.

Why This Matters for Investors and Buyers

We’re already in a property shortage of around 65,000 homes nationally. That’s a huge gap between supply and demand – and when supply is this tight, prices naturally get pushed higher.

Now, add in the fact that from October 1, first home buyers will have new incentives to enter the market. Once that wave of demand hits, competition is going to go through the roof.

It’s what I like to call the “perfect storm”:

Limited supply (massive housing shortage)

High demand (auctions going $100K+ above range with dozens of bidders)

Government-backed buyers entering the market from October

The writing’s on the wall: prices are set to rise even further.

Why Taking Action Now Matters

Every month of waiting could mean paying more for the same property. I’ve seen too many buyers sit on the sidelines hoping the market will cool off – only to get priced out entirely.

The reality is, the best time to act is before the competition ramps up even further.

As a buyer’s agent at Baker Advocates, I help my clients:

Cut through the noise and identify high-performing suburbs.

Secure investment-grade properties before the wider market catches on.

Negotiate with confidence in heated conditions like the one I just witnessed.

The market isn’t slowing down – it’s speeding up. And with October around the corner, the pressure cooker is only getting hotter.

If you’ve been sitting on the fence, now is the time to get serious about your strategy.

What History Tells Us About the Property Market and Interest Rates.

When interest rates drop, property prices often start to climb but not always in the same way, and not in every location. If we look back over the past 20 years, we’ve had three big “rate cut cycles,” each shaping the Australian property market in its own way. Understanding these trends can give you an edge when deciding where (and when) to buy.

What History Shows Us

2008 – The Global Financial Crisis

When the cash rate fell from above 7% to just 3%, buyers jumped in. National house prices rose by 19% between 2009 and 2010. The improved affordability meant more people could enter the market and they did.

2011 to 2017 – The Long Slide

Rates dropped from 4.75% to a then-record low of 1.5%. Over those years, national prices climbed 33%, but the growth wasn’t even. Sydney boomed with a massive 77% jump, while other cities, like Brisbane, Adelaide, and Perth, had a far more modest lift.

2019 to 2020 – The COVID Boom

When rates were cut from 1.5% to 0.1%, we saw the fastest, most widespread property boom in modern history. Low borrowing costs fuelled a buying frenzy, and competition for property went through the roof.

Why the Impact Isn’t the Same Everywhere

1. Affordability – The Big Driver

High-priced markets are the most sensitive to interest rate changes because buyers there rely more on finance. When rates drop, their borrowing power jumps and so does demand. Think inner Sydney, Melbourne, Brisbane, Adelaide, and Perth.

2. Where a City is in its Growth Cycle

If a market is at the start of its upswing, cheaper money can push it forward faster. Melbourne is a great example right now strong population growth, a recovering economy, and more demand building. Lower rates could give it serious momentum.

3. Local Economic Health

A booming local economy supercharges the effect of rate cuts. Perth’s muted response to the 2019–2020 cuts turned into real growth only after the economy picked up in 2022.

Which Areas Could Benefit Most This Time

Sydney: Always the first to react. Inner-city markets with median prices well over $3 million are set to feel the biggest boost in demand.

Melbourne: Positioned for a comeback after years of modest growth.

Brisbane, Adelaide, Perth (Inner-City): Likely to see improved recovery thanks to better affordability.

Canberra & Hobart: Smaller markets showing early signs of recovery could strengthen further.

What This Means for Investors

Interest rates are just one piece of the puzzle. You still need to look at supply and demand, local economies, and where each market is in its cycle. While some cities might see rapid growth, others may grow steadily and steady growth often means more sustainable returns.

At Baker Advocates, we’re constantly tracking these market shifts to identify locations that can outperform the national average not just for the next year, but for the long term.

Final Thought

Rate cuts can open the door to opportunities, but only if you know where to look. Whether you’re aiming for a high-growth hotspot or a steady long-term performer, it’s about timing your move and choosing the right market.

If you’re ready to take advantage of these conditions without the stress of trying to figure it all out alone — click the link below to book a discovery call. We’ll walk you through the best strategies for your situation and help you secure an investment property with the potential to grow, even as the market shifts.

The Australian property market is quietly heating up again — but this time, it’s not about boom-and-bust. It's steady, calculated, and strategic growth. And for investors? That’s the sweet spot.

The Market's Moving — Here's What That Means for Property Investors in 2025

Property values across Australia rose 0.6% in June, making it five months in a row of growth. It’s not a headline-grabbing number, but here’s what most people miss: steady growth = strategic buying conditions

June 2025 Recap: A Market on the Move

Property values across Australia rose 0.6% in June, making it five months in a row of growth. It’s not a headline-grabbing number, but here’s what most people miss: steady growth = strategic buying conditions.

We’ve come out of a flat patch, and thanks to interest rate cuts starting back in Feb, things have started to turn. And while this isn’t another boom we’re okay with that. Because smart, long-term investing has nothing to do with chasing hype and everything to do with buying quality assets in the right markets.

At Baker Advocates, this is exactly the kind of environment we thrive in. We help our clients take action while others sit on the sidelines, overwhelmed by media noise or trying to time the market perfectly (spoiler: no one ever does).

Where’s the Growth Happening?

Across the board, we’re seeing movement. But not all markets are created equal.

✔️ Darwin saw the biggest quarterly jump at 4.9%, finally pushing past its mining boom peak from 2014

✔️ Brisbane and Perth continue to lead the pack in the longer-term growth game —up 81% and 75% over the past 5 years

✔️ Melbourne and Sydney are recovering from previous dips smart investors are circling for value buys

✔️ Regional markets still have legs, but capital cities are gaining momentum again

Our clients don’t guess — we use data to identify investment-grade locations with the fundamentals in place: low supply, strong demand, proven growth, solid rental yield, and the lifestyle factors Aussies actually want.

What About Rents?

You’ve probably heard that rental growth is slowing. That’s true but it’s not the red flag some people think it is.

Nationally, rents rose 1.3% over the June quarter, and annual growth is sitting at 3.4%. That’s a big drop from the frenzy of 2021, but it’s also more sustainable and predictable which is a good thing for long-term investors.

Vacancy rates are still tight (hello, Sydney at 1.8%), and the market is settling into a rhythm. That gives you more confidence in cash flow, especially when we help you buy in markets with strong rental demand and limited supply.

Capital City Snapshots – What Investors Should Know

Here’s the short version of what’s happening on the ground:

🔹 Brisbane: One of our favourite plays right now. Units up 10.9% over the year, driven by affordability pressures and tight supply. High growth, high yield, high impact.

🔹 Perth: Back on a roll — $54K in value gains over the financial year. Affordability + demand = recipe for success.

🔹 Melbourne: Slowly climbing back, still sitting 3.9% below its 2022 peak a buying opportunity for those who missed out last time.

🔹 Sydney: Home values up 1.9% in the first half of 2025. Units outperforming houses. We’re seeing some great entry points in the right suburbs.

🔹 Darwin, Hobart & Canberra: Niche markets with strong rental yields and unique growth drivers. Good opportunities for the right investor profile.

Tailwinds & Headwinds: What’s Coming Next

There’s a mix of factors in play some will help fuel growth, others might hold it back.

Positives for the market:

✅ Interest rates expected to keep dropping potentially back into the 3s or high 2s

✅ Confidence is creeping back in

✅ Housing supply is still way too low

Negatives for the market :

⚠️ Affordability is still tough in some markets

⚠️ Population growth has cooled a bit

⚠️ Global risks (yep, they’re still a thing)

So what does that mean for you? Opportunities are there — but you’ve got to be strategic.

How This All Ties Back to You

If you’re looking to get started in property investing or thinking about growing your portfolio this kind of market is ideal. Prices aren’t flying out of reach, interest rates are easing, and competition is lower than in a boom.

The problem is most people get stuck. They don’t know where to buy, what to avoid, or how to actually take the first step without stuffing it up.

That’s exactly what we help with.

At Baker Advocates, we handle the entire process for you:

📍 Find growth-focused markets using our proven Foundation8 Blueprint

💰 Identify properties that tick the capital growth AND cash flow boxes

🤝 Negotiate the best deal and handle the due diligence

🏡 Connect you with brokers, conveyancers, and property managers

📈 Set you up with a strategy that aligns with your long-term goals

No stress. No confusion. Just a clear path to building wealth through real estate.

Ready to take action while the rest of the market hesitates?

Source: Cotality’s Monthly Home Value Index. www.cotality.com.au

Inflation Has Crashed Below Target — So Why Are Rates Still High?

The RBA Might’ve Gone Too Hard, Too Fast

There’s growing concern that the RBA has made some serious missteps over the past 12 months. By hiking rates aggressively and holding them high, they’ve arguably overcorrected — and the consequences are showing.

Let’s break it down.

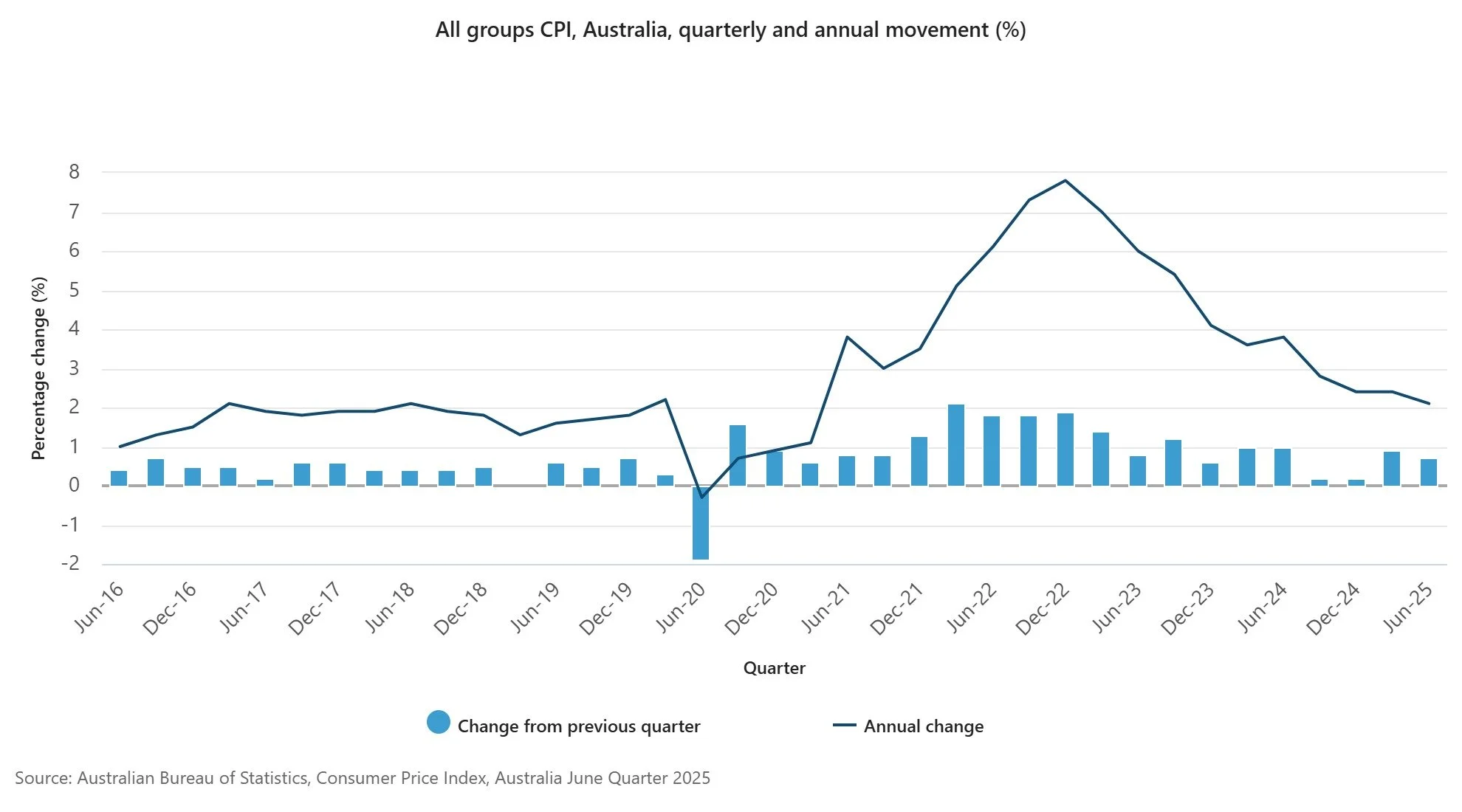

The latest inflation data out of Australia is nothing short of staggering and it could have major implications for property investors. Using the monthly CPI figures, which are more up-to-date than the quarterly stats, inflation has now dropped to just 1.9% well below the RBA’s official target range of 2–3%.

Even the “trimmed mean” measure which filters out volatile price spikes is sitting at 2.1% annually.

To put that into context: this time last year, we were staring down a 6% inflation rate and back-to-back interest rate hikes. Fast forward to now? Inflation is not only under control it’s below where the Reserve Bank wants it to be. And yet, interest rates are still sitting at a restrictive 3.85%.

That’s where things get frustrating.

The RBA Might’ve Gone Too Hard, Too Fast

There’s growing concern that the RBA has made some serious missteps over the past 12 months. By hiking rates aggressively and holding them high, they’ve arguably overcorrected and the consequences are showing.

GDP growth has been limping along, stuck under 2% for the past two years.

Unemployment has ticked up to 4.3%, after bottoming out at 3.5%.

Consumer spending has dropped. Businesses are pulling back.

And most importantly inflation has already come crashing down.

Many economists now believe the RBA should have already started cutting rates. The data is there. The pressure on Aussie households is very real. And by keeping rates higher for longer, the RBA is putting further strain on the economy potentially risking thousands of jobs in the process.

So, What’s This Mean for You as an Investor?

For property investors, especially those getting started, timing matters. A slowing economy and falling inflation typically signal a rate cut cycle ahead and historically, when interest rates fall by 1%, property prices increase by around 8%.

This could be the window smart investors have been waiting for.

If you’ve been sitting on the sidelines, unsure whether now’s the right time to enter the market you might want to look twice. When rates eventually drop (and all signs are pointing that way), we could see another wave of competition hit the market.

Early movers are usually the ones who benefit the most.

Why the RBA Needs to Pay Attention to Monthly Data

A big part of the debate right now is how the RBA interprets inflation data. While the monthly CPI gives us a real-time pulse on the economy, the RBA has been placing more weight on the older, quarterly numbers.

But here’s the thing: the monthly numbers are picking up the turning point now. Not two months from now. Not next quarter.

If the RBA continues to ignore the current data, we risk deeper economic pain more job losses, more pressure on households, and more missed opportunities.

What Needs to Happen Next

There’s a strong case for the RBA to:

Deliver a 50 basis point rate cut as early as August.

Follow with additional 25 basis point cuts in the months ahead.

Shift to a more accommodative policy setting somewhere closer to 3.25% or lower.

Because let’s face it — if inflation is already below target and the economy is slowing, keeping rates high is only going to make things worse.

At Baker Advocates, we watch these trends closely not just for the macro view, but because they impact your decisions as an investor. Whether you’re buying your first investment property or planning your next move, understanding the broader economic picture helps you act with confidence.

Right now, we’re seeing a rare alignment:

✔️ Inflation is under control

✔️ Rate cuts are likely coming

✔️ Buyer competition hasn’t returned in full force yet

If you’ve been waiting for the right conditions to build your portfolio — this could be your moment.

Want help navigating it?

We help everyday Aussies invest smarter, avoid the common pitfalls, and secure high-performing properties across Australia. Click the link below to book your free discovery call and let’s talk strategy.

The Hidden Step Most Property Buyers Miss. And Why It Could Cost You!

When most people start the journey of buying an investment property, they focus on the obvious things — finance, finding the right suburb, and inspecting properties.

But there’s one critical step that often gets overlooked…

And missing it could cost you time, money, and a whole lot of unnecessary stress.

The mistake?

Waiting too long to involve your solicitor or conveyancer.

Most buyers wait until after they’ve signed a contract or are right on the edge of doing so to engage their legal team. By that point, they’re under pressure. They’re rushing to understand contract terms, meet cooling-off deadlines, or scramble to negotiate clauses they should’ve discussed earlier.

Here’s what seasoned investors (and experienced buyer’s agents 😉) do differently:

Involve Your Legal Team Before You Make an Offer

It might seem like a small thing, but looping in your solicitor or conveyancer early in the process gives you a strategic edge.

Here’s why:

✅ They can spot red flags in the contract, zoning, title, or even the suburb itself before you're emotionally attached to the deal.

✅ They can help you negotiate smarter, adding special conditions that protect your interests.

✅ You can act faster, because everything’s already in motion when the right opportunity lands.

Real Talk: This Is How You Win

In competitive markets, speed and confidence matter.

When your team is prepped and ready, you’re not just reacting you’re leading the process. And in property investing, that often means getting a better deal, avoiding legal headaches, and reducing the risk of costly surprises post-settlement.

At Baker Advocates, we help our clients navigate all of this from sourcing the right investment property in a high-performing area, right through to settlement and handover. That includes connecting you with a trusted legal team so you're covered from day one.

Ready to start your investing journey the smart way?

Click below to book a free discovery call and let’s talk about how to make your first (or next) investment property a seamless, strategic success.

Troy – Buyer’s Agent & Founder

Baker Advocates

Think. Plan. Execute.

The Secret to Picking Suburbs That Actually Grow

Finding the right suburb in your property investment journey is one of the most important steps you need to take.

How to Avoid the Dud Suburb Trap and Invest with Confidence

Let’s be honest, there’s nothing worse than buying your first investment property, only to watch it sit there… doing nothing. No capital growth, no real income, just silent stress eating away at your plans for financial freedom.

Unfortunately, this happens all the time to first-time investors who pick the wrong suburb.

We’ve seen it too often: people buy in the wrong area based on gut feel, hype, or a "cheap" deal, or what Uncle Tony said and a decade later, they’ve got nothing to show for it. The worst part? It could’ve been avoided with the right strategy and a bit of data.

So, how do you avoid this mistake and pick suburbs that actually perform?

Let’s break it down...

Why Most Investors Get It Wrong

Most beginner investors fall into one of two traps:

They chase cheap suburbs without looking at growth potential

They buy in areas they think will do well, but the data says otherwise

Buying a cheap property in a suburb with low demand and poor fundamentals is like buying a car with no engine it might look good, but it won’t take you anywhere.

The Power of Property Data

At Baker Advocates, we don’t rely on guesswork we use data to guide every investment decision.

Here’s what we’re looking for when assessing a suburb:

Strong long-term price growth

Low rental vacancy rates (ideally under 3%)

Tight inventory levels (a sign of demand outweighing supply)

Demographic trends (e.g., growing population and income levels)

Infrastructure projects and future growth drivers

When all of these boxes are ticked, we know we're onto something special.

Why Rental Demand Matters Just as Much

A growth suburb is great—but it also needs to rent well. After all, you want consistent rental income, not a property that sits empty for months on end.

We always check:

Vacancy rates (the lower, the better)

Inventory levels (less supply = more tenant competition)

Tenant demographics (are renters moving in and staying long-term?)

A suburb with high demand and tight supply means less vacancy risk and better-quality tenants which makes your investment work for you, not against you.

How We Do It at Baker Advocates

We use a proven 8-step system called the Foundation8 Blueprint, where we research and cross-check suburbs based on:

✅ Capital growth trends

✅ Rental performance

✅ Economic indicators

✅ Walkability and lifestyle factors

✅ School zones and amenity access

We’re borderless, meaning we look nationwide for the best-performing pockets—so you’re not limited to what’s “close to home.” It’s about finding the right suburb, not just a familiar one.

Your Suburb Selection Checklist ✅

When you're choosing where to invest, run through this quick list:

📈 Long-term price growth (above national average)

🏠 Low rental vacancy rate (2–3%)

🛍️ Access to schools, shops, transport

🚧 Infrastructure or major projects nearby

💼 Economic drivers and local jobs

👥 Positive demographic trends

Knowledge is Power (and Profit)

If you're serious about building wealth through real estate, picking the right suburb is one of the most important decisions you’ll make.

If you want to avoid the costly mistakes and emotional decisions that hold most investors back, jump on a call and get started with us. We guide you to growth markets with confidence, clarity, and support every step of the way.

Want to find your growth suburb?

Click the link below to book your free Discovery Call and let’s map out a plan to help you invest smarter.